Mastering Candlestick Patterns on Exmo: A Powerful Trading Tool

Mastering Candlestick Patterns on Exmo: A Powerful Trading Tool

With an ever-increasing interest in cryptocurrency trading, it’s crucial to have the right tools and knowledge to make informed decisions. One powerful tool that can significantly enhance your trading results is mastering candlestick patterns on Exmo. In this blog post, we will explore what candlestick patterns are and how you can effectively utilize them on the Exmo trading platform.

Understanding Candlestick Patterns

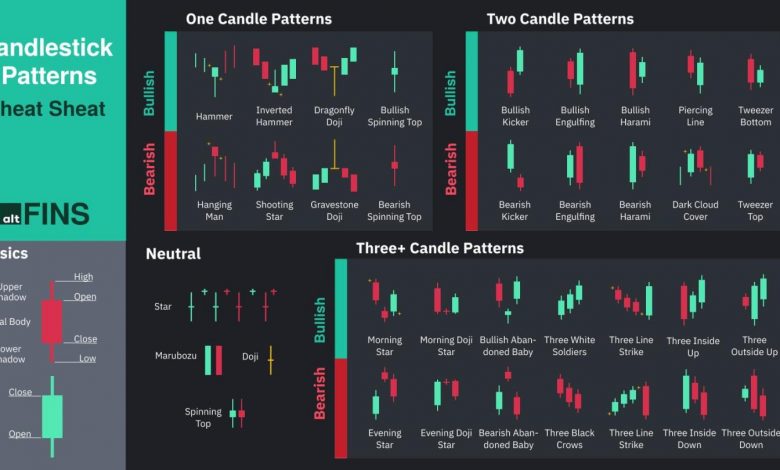

Candlestick charts have been used for centuries by Japanese rice traders, and they have proven to be an effective way of analyzing and predicting market trends. Each candlestick represents a specific period of time, such as a day or an hour, and provides valuable information about the price movement during that time.

Basic Candlestick Patterns

Some basic candlestick patterns include:

1. Doji: This pattern occurs when the opening and closing prices are very close or virtually the same. It indicates indecision in the market and could signal a potential reversal.

2. Hammer: A hammer candlestick has a small body and a long lower shadow, resembling a hammer. It suggests a potential bullish reversal after a downtrend.

3. Engulfing: This pattern occurs when one candle completely engulfs the body of the previous candle. Bullish engulfing patterns can signal a bullish reversal, while bearish engulfing patterns indicate a potential bearish reversal.

Advanced Candlestick Patterns

Once you have a good understanding of the basic patterns, you can move on to more advanced candlestick patterns, such as:

1. Three White Soldiers: This bullish reversal pattern consists of three consecutive long bullish candlesticks with higher highs and higher lows. It suggests a strong uptrend and can be an excellent buying signal.

2. Dark Cloud Cover: This bearish reversal pattern occurs when a bullish candlestick is followed by a bearish candlestick that opens higher but closes below the halfway point of the previous candlestick. It indicates a potential trend reversal and could be a signal to sell.

Utilizing Candlestick Patterns on Exmo

Now that you have a grasp of candlestick patterns, it’s time to apply your knowledge on the Exmo trading platform. Exmo provides powerful charting tools and features that can help you identify and analyze various candlestick patterns.

1. Custom Candlestick Timeframes: Exmo allows you to customize the timeframes of your candlestick charts. This flexibility enables you to zoom in or out, depending on your trading strategy and the patterns you want to identify.

2. Pattern Recognition Tools: Exmo also offers pattern recognition tools that automatically identify and highlight candlestick patterns on your charts. This feature can save you time and help you spot potential trading opportunities quickly.

Frequently Asked Questions (FAQs)

Q: Can I use candlestick patterns for day trading on Exmo?

A: Absolutely! Candlestick patterns are widely used by day traders on Exmo to identify short-term trading opportunities. By mastering candlestick patterns, you can make more informed day trading decisions.

Q: Do candlestick patterns guarantee profitable trades?

A: While candlestick patterns can provide valuable insights into potential market reversals, they do not guarantee successful trades. It’s important to combine candlestick analysis with other technical indicators and fundamental analysis for more accurate predictions.

Q: Are candlestick patterns effective for long-term investing?

A: Candlestick patterns are primarily used for short-term trading, but they can also be useful for long-term investors. By identifying reversal patterns, investors can make better entry and exit decisions, improving their long-term investment returns.

In conclusion, mastering candlestick patterns on Exmo can be a powerful tool in your trading arsenal. By understanding and effectively utilizing candlestick patterns, you can enhance your trading decisions and improve your overall profitability. Use the Exmo trading platform’s charting tools and features to your advantage, and remember to combine candlestick analysis with other technical indicators and fundamental analysis for best results. Happy trading!